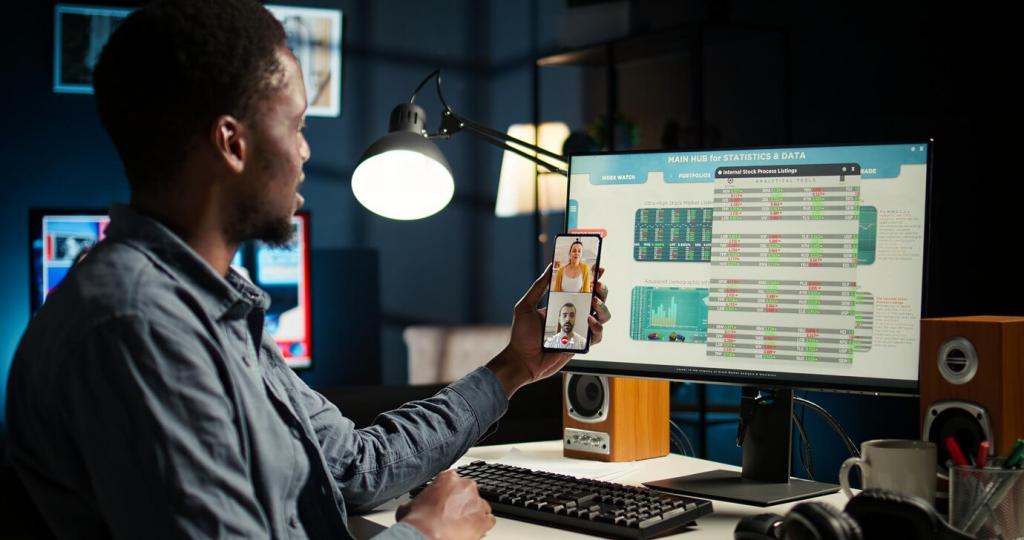

Enhancing Financial Literacy with Fintech Innovations

Today’s chosen theme is Enhancing Financial Literacy with Fintech Innovations. Step into a friendly space where modern apps, clear stories, and practical tools turn confusing money rules into everyday confidence. Learn, experiment, and subscribe for hands-on tips that move your finances forward.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Bite-sized lessons you can finish on the bus

Micro-lessons break topics like APR, compound interest, and emergency funds into two-minute stories. You tap through examples, try a quick scenario, and immediately see how one choice affects future outcomes—no jargon, just clarity and momentum.

Points and progress bars that mean something

Gamified streaks and progress bars are not fluff when they reflect real skills. Earn milestones for building a cushion, lowering utilization, or completing a budgeting cycle, making learning feel tangible, encouraging celebration, and sustaining your motivation.

Nudges at the right moment, not the wrong one

Smart nudges appear when you add items to a cart or cross a spending threshold. Instead of shaming, they offer alternatives—like a savings challenge reminder—so you consistently practice better choices during the moments that actually matter.

Budgeting and Saving Tools That Teach by Doing

Auto-categorization with human-friendly context

When transactions auto-categorize, the app also explains why. A short note shows how frequent delivery orders impact your monthly surplus, guiding you to tweak limits and re-allocate toward goals without judgment or complicated spreadsheets.

Round-ups, goal vaults, and visible progress

Round-up savings funnel spare change into named vaults—rainy day, travel, or debt payoff. Watching the bar fill after each purchase makes saving visible, turning micro-choices into a steady habit you can trust and celebrate weekly.

Weekly reflection that builds financial intuition

A gentle Sunday summary surfaces wins, slips, and one actionable tweak. You might see, for instance, that moving a subscription to post-payday smooths cash flow, reinforcing learning and nudging small experiments that compound into lasting stability.

Security, Transparency, and Trust You Can Understand

Privacy policies in everyday language

Instead of dense legal walls, transparent summaries explain what data is used, why it helps your literacy journey, and how you can opt out. Understanding consent builds confidence, encouraging you to explore features that actually improve outcomes.

Security steps as empowering rituals

Two-factor authentication, biometric unlock, and transaction alerts are framed as personal safeguards, not hurdles. When protection feels respectful and helpful, you engage more deeply, learn comfortably, and make bolder but well-informed financial decisions.

Export, portability, and your right to leave

Knowing you can export data and move on reduces lock-in anxiety. Transparent portability fosters trust, letting you focus on learning, templating budgets, and experimenting with new tools without feeling trapped or pressured to stay.

From Knowledge to Habits: Designing Follow-Through

Implementation intentions you can tap

Turn goals into if-then plans: If rent clears, then move ten dollars to savings. The app schedules the trigger, logs results, and celebrates streaks, transforming abstract advice into reliable, repeatable routines.

Automation with training wheels

Start small automations with built-in guardrails, like weekly caps and instant pause. You practice consistency without risking overwhelm, learning to trust systems that keep progress steady through busy seasons and unexpected expenses.

Community accountability that motivates kindly

Opt into a supportive circle where peers share goal updates and small wins. Light, encouraging check-ins—and no shame—create momentum, reminding you that skill-building is a shared journey, not a solitary grind.

Your Turn: Share, Subscribe, and Shape What Comes Next

Comment with one decision you face this week—budget tweak, credit move, or savings trade-off. We will turn common themes into clear walkthroughs and publish examples you can apply immediately without extra complexity.

Your Turn: Share, Subscribe, and Shape What Comes Next

Join our mailing list to receive a two-minute challenge every week. Expect tiny experiments, helpful checklists, and delightful visuals that make learning stick without stealing your time or overwhelming your schedule.