Understanding Fintech's Role in Modern Finance Management

Chosen theme: Understanding Fintech’s Role in Modern Finance Management. Step into a practical, human-centered exploration of how financial technology reshapes budgets, investing, payments, and decisions—so you can manage money with clarity, confidence, and momentum.

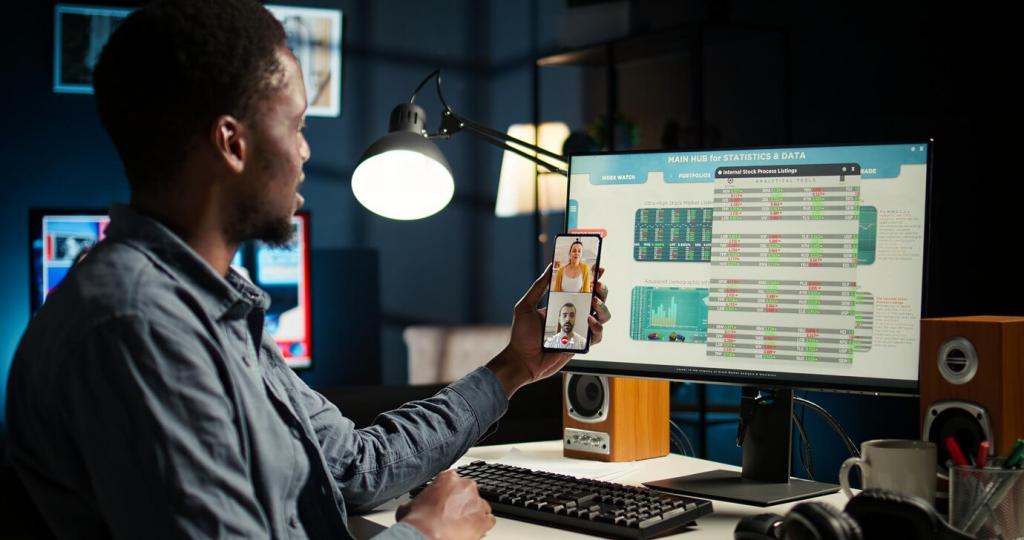

The Fintech Shift: How Technology Rewires Money Management

From ledgers to live dashboards

Not long ago, finance meant static spreadsheets and monthly statements. Fintech turns that lag into live dashboards, surfacing cash flow, upcoming bills, and investment performance in real time. The result is awareness, timely action, and fewer costly surprises.

Personal Finance: Everyday Decisions Made Intelligent

Modern budgeting apps categorize spending instantly, set gentle alerts before overspending, and forecast end-of-month balances. By turning numbers into timely nudges, they reduce guilt and increase follow-through, making disciplined habits feel supportive rather than restrictive.

Personal Finance: Everyday Decisions Made Intelligent

Round-ups, recurring transfers, and rules-based saving funnel small amounts into goals without friction. Micro-investing platforms make diversified portfolios accessible with minimal balances, helping new investors overcome hesitation while learning with real stakes, not intimidating lump sums.

Security, Compliance, and Trust: The Foundation of Fintech

Defense in depth, explained simply

Encryption, tokenization, and hardware-backed authentication protect sensitive information in transit and at rest. Fintech providers also monitor anomalies, isolate suspicious activity, and require multi-factor authentication. These layers minimize breach risk and strengthen everyday security hygiene.

Regulation and open banking

Open banking frameworks let you share specific financial data securely with your chosen apps. Consent, scope, and revocation are clear. Combined with regulated institutions and audited controls, this infrastructure allows innovation without abandoning accountability or transparency.

Data and AI: Turning Signals Into Smarter Moves

Responsible lenders evaluate cash flow patterns, recurring income, and bill payment history, complementing traditional credit scores. This approach can widen access to credit for thin-file applicants while maintaining risk discipline, provided models are monitored for bias and drift.

AI analyzes spending rhythms, savings goals, and market conditions to suggest timely, relevant actions. Great products explain why a suggestion appears, offer opt-outs, and provide plain-language reasoning. Clarity builds trust, and trust drives better adoption and outcomes.

When models affect lending, investing, or fraud checks, explainability is essential. Users deserve reasons behind decisions and avenues for appeal. Teams that prioritize transparency reduce frustration, meet regulations, and build resilient, long-term customer relationships anchored in understanding.